"It is

impossible for ideas to compete in the marketplace if no forum for

their presentation is provided or available." � �Thomas Mann, 1896

PERSONAL

WIRELESS DEVICES

Business

Applications -

You

Can Take It With You:

Author: Mike Ellsworth

Contributed

by: Stratvantage Consulting, LLC

Introduction:

This white paper is already obsolete.

That�s how fast wireless technology is moving today. Each day, almost each hour of each day, brings a new announcement of a wireless feature or capability. Part of the reason why is the huge range of wireless options being developed today, including:

-

Phone Services/Cellular Networks � This area includes standard person-to-person telephone features over a cellular network as well as PCS features such as emailing to the phone, instant messaging, and paging. Also included in this segment are unified messaging efforts that bring together voice mail, email, and wireless access.

-

Information Services � These services range from traditional paging services, to interactive paging, Web browsing on PDAs and browser-equipped phones and pagers, and wireless access to corporate resources such as documents and email.

-

Commerce Services � Commerce-enabled mobile phones are making m-commerce, or mobile commerce, a reality in Japan and Europe, where you can buy a cute icon for your phone, play a game with a remote opponent, or do your banking wirelessly. In various stages of adoption are location-based services that allow purchasing (and advertising) based on proximity to a vendor.

-

Geographic Services � One type of location-based services specializes in assisting navigation through detailed maps and Global Positioning Service (GPS) wireless satellite connectivity. Another service involves tracking physical assets as diverse as trucks and telephone central office equipment through Radio Frequency (RF) tags that may also have GPS capabilities built in.

-

WAN and LAN Services � These services allow more-traditional computing devices such as laptops to connect in an �always on� network. They include fixed wireless efforts such as those based on the 802.11b, or Wi-Fi, standard that create local Neighborhood Area Networks (NANs), longer haul services that connect corporate sites together, airborne and satellite services that provide high-speed Internet access, and Personal Area Networking (PANs) such as Bluetooth.

-

Fixed Wireless Broadband Services � Often sold as an alternative to the slow �last mile� to the home, fixed wireless services typically use roof-mounted antennas to deliver fast broadband connections. Also included are satellite broadband and access services delivered via aircraft stationed in the stratosphere above major cities.

-

Voice Activated Services � While not strictly a wireless initiative, the development of voice services from voice navigation on cell phones or in cars (OnStar) to Internet-driven information services such as TellMe or those based on technology from Nuance to voice recognition will profoundly affect wireless services.

-

Automotive Telematics � Your car is rapidly becoming your office, with GPS navigation, emergency, and concierge services as well as access to email, the Web, and corporate resources.

-

Convergent Services � What happens when the phone and the pager and the PDA converge into a single device? Well, it depends a lot on from which direction the convergence comes. Converged devices from cell phone makers tend to look and act more like phones than computers. On the other hand, devices from PDA or handheld computer makers look and act more like computers than phones. And some devices are descended from pagers that have incorporated telephone functionality.

So it�s a

broad field, and one rife with both opportunity and pitfalls. Wireless

technology is moving so fast that if you blink, you�ll miss something.

Overview

Since Sprint�s

introduction of PCS phone services in 1994, the US wireless industry has

evolved from a niche player that offered expensive voice services on clunky,

First Generation (1G) analog equipment, to a nearly ubiquitous presence in

corporate and consumer America. At the same time, non-voice-based information

services on wireless phones have proliferated.

Most cell phones

purchased today have the ability to not only receive email and other short

messages and to act as pagers, but also to browse the Web, compose emails and

Instant Messages (IM) and keep track of appointments and other personal

information. While nearly half (48 percent) of all cell phones bought at

retail in Q2 2000 were Net-ready � a tenfold jump from the same period in

1999, according to the NPD Group

�

today there are 18 million wireless Web users in the US, according to

eTForecasts.

In fact, many new phones can play MP3 music files or receive FM broadcasts.

Mobile commerce,

or m-commerce, is also developing rapidly. Today, for example, Sprint

customers can buy books at Amazon using their phones and send gifts using the

recipient�s email address.

Overseas,

wireless phone capabilities are even more advanced.

In Europe, m-commerce enables users to purchase many goods and services

and even doing banking using their wireless phones. Deutche Telekom, in fact, is even considering issuing its own

electronic currency. In Japan, 26 million NTT DoCoMo customers enjoy

sophisticated services including news

feeds, games, video and music on phones that

include color screen models. Users

pay for services through charges on their monthly bills.

In the sections that follow, we take a look at evolving devices and cellular networks, the trends affecting mobile professionals, and the convergence of personal devices. In addition, we make recommendations on how businesses can take advantage of wireless opportunities, including a look at wireless application categories.

Wireless Momentum

Phone Services and Cellular Networks Are Evolving

-

Since 1998 the number of US wireless telephone subscribers has more than doubled, to 130 million. Subscribers use their cell phones an average of 422 minutes a month, up 75 percent from two years ago. Wireless service providers have tripled the number of cell sites since 1997 to more than 114,000, which is six times the number available in 1995.

-

The US lags the rest of the world in wireless development, but South Korea puts us all in the shade. More than half of Korea's 15 million households have broadband service, more than 60 percent of South Koreans carry cell phones, and one South Korean telco is already providing 3G (Third Generation) service.

-

Goldman Sachs Equity Research predicts there will be more than a billion mobile phone users worldwide by 2003.

-

Despite all the hype about wireless, Gartner Dataquest said that overall global mobile phone sales to consumers went down by 3.2 percent to 399.6 million units in 2001. The company says reasons for the drop include saturated European markets, a decrease in subsidies by telecommunications operators and gray, unlisted imports from overstocked distributors. The Yankee Group predicts that in 2002, about 436 million handsets will be sold worldwide, increasing to 596 million by 2005.

-

Next generation General Packet Radio Service (GPRS) networks, featuring faster data transfer speeds, have gotten an unexpectedly lukewarm reception from US users, according to John Filar Atwood, an equity research analyst for Multex Investor.

What is a G?

Cellular

networks have undergone two major generational changes in the last 10 years

and are in the midst of a third.

1G

� First generation cell phones were based on analog technology and handled

only voice.

2G

� Second generation cell phones are digital and most offer data services

like text messaging and Web access.

2.5G

� A transitional generation of phones is being introduced today featuring

higher speed data access. General Packet Radio Service (GPRS), being rolled

out in the US by AT&T and VoiceStream, features roughly 40Kbps data

access. Verizon has released and Sprint is readying CDMA2000 1XRTT networks

that feature up to 144Kbps data access.

3G

� Third generation networks must support at least 384Kbps data access. SK

Telecom in South Korea and NTT DoCoMo in Japan have rolled out the only

commercial 3G networks so far.

The

Generation Gap

The big deal in

wireless phone services is the introduction of so-called 3G, or Third

Generation, services. The major intent of these services is to provide

higher-bandwidth data access, although cellular network operators will get

more voice capacity as well.

Current cell

phone networks are considered 2G, or Second Generation, and are based on two

(or two-and-a-half, if you�re picky) competing standards:

-

GSM/TDMA � GSM (Global System for Mobile communication) is the standard in most of the world outside North America. GSM is based on the TDMA (Time Division Multiple Access) standard, which is used by AT&T in the US. In GSM/TDMA systems, cell phones share a radio channel in turn, with each getting a time slice in which to transmit. VoiceStream and Cingular use GSM in the US, and AT&T is converting its network to the standard.

-

CDMA � Invented by Qualcomm, CDMA (Code Division Multiple Access) networks exist mostly in North America, where they support 80 to 90 percent of cell phones. In CDMA systems, cell phones all talk at once, but use different identifiers to sort out the conversations. Experts claim that CDMA can support many more cell phones per channel than competing strategies. Sprint and Verizon use CDMA in the US.

The 3G Goal

The goal of all

cellular network providers is to transition to 3G services, primarily to be

able to provide high speed data services, including streaming audio and video,

to phones and other devices. The 3G standard is defined by the International

Telecommunications Union. Unfortunately, the ITU will not require all 3G cell

phones to work on competing networks. It has created a specification known as

IMT-2000 that defines requirements of 3G networks, but it has stopped short of

mandating the type of network scheme necessary to fulfill the requirements.

A wireless

network must meet several requirements to be certified as IMT-2000, or 3G.

Among them are a minimum 144Kbps data throughput in a mobile situation,

384Kbps for pedestrian use and 2 megabits per second for fixed use. There are

other required parameters such as voice quality and capacity, but the speed

requirements are generally the ones most focused upon.

Since the ITU couldn�t achieve their goal of allowing devices to roam on any network in the world, they�ve settled for blessing divergent standards under the IMT-2000 umbrella. Among them are:

-

W-CDMA � Known in Europe as UMTS (Universal Mobile Telecommunications System), and as FOMA (Freedom Of Mobile multimedia Access, a branded service of NTT DoCoMo) in Japan, the standard is capable of meeting the 384Kbps transmission rates required of 3G. In Japan, DoCoMo, who created the W-CDMA standard, enables FOMA users to send and receive video on a compact phone with a color screen. Unfortunately, UMTS and FOMA are not compatible, despite being based on the same standard.

-

CDMA2000 � Developed by Qualcomm, which created the original CDMA standard, CDMA2000 has three phases:

-

1XRTT, with data rates up to 144 Kbps (also known as 1X). In the US, Sprint and Verizon are currently rolling out 1XRTT networks. Some critics claim this standard does not qualify as 3G.

-

3XRTT, with data rates up to 2Mbps (also known as 3X).

-

Two versions of the CDMA2000 1X EV standard: CDMA2000 1X EV-DO (�Data Only�), which will use separate frequencies for data and voice; CDMA2000 1X EV-DV (�Data and Voice�), which will integrate voice and data on the same frequency band.

-

TD-CDMA/TD-SCDMA � The TD-CDMA standard was developed by Siemens, and then modified in collaboration with the Chinese government to become TD-SCDMA. Its main claim to fame is rather technical: It doesn�t require paired spectrum, which means it doesn�t require one radio frequency for outgoing data and a separate one for incoming. Instead, this standard rapidly switches between receiving and transmitting on the same frequency, thus removing the requirement to say, �Over� and preserving the ability to interrupt the other party during a phone call. These standards are mostly of interest because of their adoption by populous China.

Regardless of

how they get there, cellular network operators are planning on reaping

significant revenues from new 3G services.

The Road to 3G

Since going

directly to 3G systems is prohibitively expensive for most cellular network

vendors, the industry is pursuing a variety of so-called 2.5G solutions:

offerings that are better than 2G, but don�t meet 3G criteria. Some vendors

are hyping their 2.5G solutions, such as Sprint and Verizon�s 1XRTT, as full

3G. (Critics of such hype say if the standard can�t do 2Mbps stationary

connections, it�s not 3G.) Others are adopting 2.5G solutions as a less

expensive way to eventually migrate to 3G.

The two most popular 2.5G transition standards, GPRS and EDGE, help network operators make a critical transition from circuit-switched networks (in which there are dedicated resources for every conversation, like on the wired telephone network) to packet-switched networks (in which each transmission is broken into chunks which are routed separately, like the Internet).

-

GPRS � General Packet Radio Service is a TDMA standard closer to GSM than to AT&T�s TDMA. Primarily a software upgrade to existing GSM systems, GPRS overlays a packet-switched architecture onto the normal GSM network, which is circuit-switched. Data rates can reach 50Kbps or more, but are likely to be 20 to 40Kbps in the real world. AT&T is currently rolling out GPRS service into more than 30 US markets, and VoiceStream launched its GPRS service, branded iStream, in November 2001. Some critics claim that data rates and voice quality will suffer in real world use of the technology as users compete for bandwidth.

-

EDGE � Enhanced Data rates for Global (or GSM) Evolution is a faster standard than GPRS, reaching speeds of up to 473Kbps. Implementing the standard involves replacing network transceivers at cell sites, and many operators are opting to go to GPRS first.

All of this wonderful evolution, however, will require wireless spectrum allocations. In Europe, telecom companies have practically bankrupted themselves in spectrum auctions that earned various governments many billions of dollars. The situation is so bad many governments are working with operators to restructure or forgive some of the auction payments. In any event, many European cellular operators have spent so much money acquiring spectrum for 3G services that they can�t afford to develop the networks themselves.

In the US, no spectrum has been auctioned specifically for 3G services, and the first such auction may be two years off. Additionally, the previous round of regional spectrum auctions for 2G services have fragmented the radio spectrum, causing headaches for operators. Thus, cellular network vendors are opting for 2.5G solutions that can maximize the use of their currently allocated bandwidth.

Recommendations for Businesses

One effect of

all this 3G activity on businesses is likely to be increased costs for

replacing cell phones. In the US, cellular network vendors are going to go

through at least two steps, and in some cases three steps, to get to 3G. Each

step will probably require new cell phones to take advantage of its benefits.

In some cases, old phones will continue to work on the new network, albeit

without access to the new features. But in other cases, it�s not at all

clear that old phones will not be obsolete.

Take AT&T for example. Current AT&T subscriber phones can access three separate network types: the old analog network, and the 2G TDMA network at either of two radio frequencies. AT&T is rapidly converting its network to GSM � which is not compatible with TDMA � and GPRS. The company�s plans for how long the TDMA network will remain in place are not known but, despite being relatively well fixed for spectrum (�We have more spectrum than any of our competitors�, Mohan Gynar, AT&T Wireless president of mobility services, once boasted, there will be pressure to obsolete those TDMA phones as soon as possible.

This may not be a problem for some businesses that are already used to the roughly 24-month turnover time for cell phones we�ve been experiencing for the past few years. The problem, however, becomes multiplied because the GSM/GPRS phones that AT&T will sell you will probably need to be replaced when the company switches to the next migration step, EDGE, in a year or so. EDGE uses a completely different radio signaling technology and thus will require new phones. So unless AT&T makes TDMA/GSM/GPRS/EDGE phones available, you�ll be buying another phone when EDGE rolls out.

If your business is planning on making a bulk purchase of cell phones, be sure to ask your carrier what network changes are planned and how often you�ll need to replace those phones over the next three years. This is especially important if you are considering buying converged PDA/cell phone devices, which carry a higher price tag. There�s more about converged devices later in this white paper.

Additionally, be sure to accurately assess exactly what it is going to cost your organization to support wireless use. Avoid being blindsided by hidden costs by examining the total cost of ownership of these devices.

The cost of the phones is only one thing to worry about, however. Supporting your cell phone and PDA users as they try to leverage new wireless data capabilities could end up costing even more than equipping the users in the first place. GartnerGroup says, �Like the Titanic's encounter with a hidden iceberg, the connectivity and support costs associated with personal productivity and communications devices (PDAs, cell phones, etc.) may be a looming budget disaster.�

The 3G Bottom Line

If your business is planning on making a bulk purchase of cell phones, be sure to ask your carrier what network changes are planned and how often you�ll need to replace those phones over the next three years. This is especially important if you are considering buying converged PDA/cell phone devices, which carry a higher price tag. There�s more about converged devices later in this white paper.

Additionally, be sure to accurately assess what it is going to cost your organization to support wireless use. Avoid being blindsided by hidden costs by examining the total cost of ownership of these devices.

-

Around 55 percent of the corporate and 63 percent of the small company workforce will be either remote or mobile during 2002, Cahners In-Stat found.

-

A ResearchPortal.com report found that mobile professionals (full-time professionals over age 17 who spend 20 percent or more of their time working away from their primary working environment) in the finance industry spend more than 20 percent of their e-mail time on a handheld device such as the BlackBerry or a PDA. Mobile workers in the Information Technology, Utilities, and Construction industries all spent more than 10 percent of their email time with a small device.

-

Research firm Daratech estimated that a construction project could save from 5 percent to 10 percent using wireless and Web-based technologies. Worldwide, such tools could save as much as $400 billion annually by 2004.

PDAs Get Connected

Cell-Based Data

Although they are slow, current cell phone networks do have advantages over wireless LAN technologies. Primary among them are range and coverage.

Cell phones can communicate with base stations at distances of a mile or more whereas devices based on the 802.11b (Wi-Fi) standard are limited to 100 meters, and Bluetooth devices are limited to 10 meters.

It�s not all about phones, after

all. There are a myriad of devices that are going wireless. One very important

category for businesses to consider is the Personal Digital Assistant (PDA).

Wireless access from this type of device is relatively recent: 3Com released

the Palm VII Connected Organizer on a trial basis in May 1999. The Palm VII

and its successor, the Palm i705, access Palm�s wireless service, Palm.Net�,

which runs on BellSouth�s Mobitex network. Vendors such as OmniSky (now part

of Earthlink) offer connectivity based on the Novatel Wireless Minstrel V�

modem, which snaps on to existing Palm V or other models.

The Palm

Operating System (PalmOS) is showing up in all kinds of other wireless devices

as well, including phones from Kyocera and Samsung, and the Handspring Trēo.

We consider these converged devices in a subsequent section.

The PDA platform

is the focus of another kind of convergence as well. While Palm.Net and

OmniSky/Earthlink�s networks are based on a relatively slow (19.2Kbps,

although vendors claim speeds up to 50Kbps with compression) cell phone

technology called CDPD (Cellular Digital Packet Data), vendors are currently

offering Bluetooth, 802.11b, and GPRS (General Packet Radio System)

connectivity for the platform.

Bluetooth is the

short range (30 meters) solution spearheaded by cell phone maker Ericsson, and

positioned as a replacement for wires in connecting a device to peripherals

such as headsets or printers.

802.11b, also known as Wi-Fi, is a longer range (100 meters) and faster (11Mbps) technology. As previously explained, GPRS is a 2.5G cell phone technology offering up to 40Kbps transmission speed.

In addition to

data networking, cell phone capabilities are now offered for various PDA

devices. One of the first was the Handspring VisorPhone, a Springboard add-on

module that plugs into a Handspring Visor Palm-based PDA and turns it into a

cell phone on the Cingular Wireless or VoiceStream networks. A similar module

called the Sprint PCS Wireless Web Digital Link� adds data capabilities as

well as phone service to the Handspring. Sprint plans a software upgrade for

the unit to 3G technology that will enable faster data transmission.

Microsoft�s

wireless PDA entries are currently based on the Pocket PC operating system but

later this year will feature the SmartPhone

operating system. Users of Pocket PCs can also add wireless modems from Enfora,

Novatel, and Sierra Wireless based on CDPD or connect via cable to their cell

phones that feature wireless data service.

Other Personal Wireless Devices

Other personal

devices have also gotten into the wireless act.

Research In Motion (RIM) sells several models of its

BlackBerry two-way interactive pager. Concentrating primarily on wireless�

killer app, email, the BlackBerry can also synch with your Personal

Information Manager�s (PIM) appointment, to do, and calendar capabilities.

The new BlackBerry 5810 offers GPRS connectivity and a microbrowser for

Internet access.

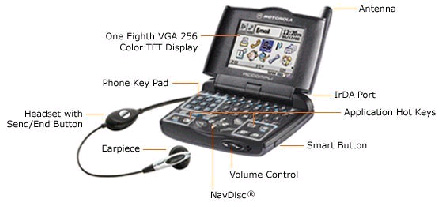

Cell phone maker Motorola, which has lagged in development of a PDA/phone combined device, saw its pager division fill the gap by integrating a cell phone with a pager. Their first effort, the Motorola v100 has been topped by the more recently released Accompli� 009 Personal Communicator, which features GPRS network access as well as PDA functions.

Personal Device Convergence

What every mobile professional really wants is to carry a single device to replace the separate devices for paging, personal organizer, Internet access, and voice communications needs. In the ideal world, road warriors wouldn�t need to lug a laptop, pager, PDA, and cell phone along. Happily there are solutions currently available and even more coming. Cell phone makers are morphing their phones into PDAs. PDA makers are morphing their devices into phones. And, as we�ve seen with the Motorola devices, pager makers are morphing their devices into phones and PDAs.

One

of the first converged cell

phones available in the US was Kyocera's year-old Smartphone. The device

combines a CDMA digital wireless phone, Web access and a Palm handheld

computer in a small 7.34-ounce package. Despite its small size, the device

looks hefty next to the newer color Samsung I300.

In Europe, the

Nokia Communicator has been available for some time. The latest version of the

device, the 9210i, is based on the Symbian operating system and features a

color screen with 4096 colors, email, productivity applications (word

processor, spreadsheet, presentation viewer), Web browsing and WAP application

access, a Flash player, and video and audio streaming (using the Real One

player) on certain cell phone networks.

Perhaps the best

option for those looking for a converged device with some staying power is Handspring�s

Trēo� Communicator, an

elegant melding of Palm PDA functionality with wireless phone and data

services. The Trēo

is a combined Palm-compatible PDA and a GSM cell phone with GPRS data access

(with service from either VoiceStream or Cingular). It�s

got everything except a cell phone partner with true national coverage: 16MB

of memory, SMS message service, a thumb keyboard like the BlackBerry, wireless

email that can access corporate email servers behind firewalls,

and the award-winning wireless web browser, Blazer�.

VoiceStream offers PDA wireless access to their GPRS iStream network, as long as you have a PocketPC-based PDA that can accept a PC Card modem like the Sierra Wireless AirCard� 555. VoiceStream's network coverage is improving, but still lags the others.

Verizon offers the same deal: get an AirCard modem and your PDA can use their 1XRTT Express Network.

Both VoiceStream and AT&T Wireless have inked deals to bring GSM voice and GPRS data services to Research in Motion�s BlackBerry pager. The BlackBerry 5810 Wireless Handheld� is already available for use on Rogers AT&T Wireless in Canada. RIM has joined with Motorola and Nextel to develop a device that will run on Nextel�s network, although is will use Motorola�s iDen networking technology to connect at only 9600bps.

Palm is said to be working on a next-generation PDA with GSM voice capability and GPRS data capability that should be ready in the fall.

The PC-Ephone,

which is based on the full-blown Windows CE operating system, unlike Microsoft�s

impending SmartPhones, features data access via the slow CDMA standard. The

device has built-in Bluetooth short-range networking capabilities. It also has

a 4-inch, 640x480 resolution, 256-color TFT LCD screen, thus bringing portable

devices into the range of desktop PCs circa 1990. Even more interesting, PC-Ephone

has licensed

Wicom Networks�

family of 802.11a products and plans to make them available in their

phones this year. (802.11a is five times faster than the 802.11b Wi-Fi

standard.

The PC-Ephone,

which is based on the full-blown Windows CE operating system, unlike Microsoft�s

impending SmartPhones, features data access via the slow CDMA standard. The

device has built-in Bluetooth short-range networking capabilities. It also has

a 4-inch, 640x480 resolution, 256-color TFT LCD screen, thus bringing portable

devices into the range of desktop PCs circa 1990. Even more interesting, PC-Ephone

has licensed

Wicom Networks�

family of 802.11a products and plans to make them available in their

phones this year. (802.11a is five times faster than the 802.11b Wi-Fi

standard.

Handheld

devices based on Microsoft�s

Pocket PC operating system probably offer one of the best protections against

obsolescence, since most feature a PC Card slot. As standards change,

businesses can swap out obsolete PC Card modems for newer ones while

maintaining their investments in the device itself.

Microsoft is planning on getting into the phone side of convergence through their SmartPhone effort. This undertaking will produce phones that feature Pocket Outlook, Pocket Internet Explorer, MSN Messenger and Windows Media Player. Microsoft and VoiceStream recently announced plans

Recommendations for Businesses

With the average cell phone user getting a new phone every two years or so, businesses have become accustomed to replacing their workers� cell phones. With the PDA-integrated phones costing north of $300, however, the decision to upgrade becomes a little harder.

If you don't want to wait for the various network upgrades that are impending, be aware that current converged devices like the Kyocera or Samsung phones are not likely to be able to transition to GPRS or EDGE networks.

It may make more sense to get a

device that supports GPRS access. Unfortunately, the devices offered by US

GPRS operators use the phone form factor, and thus share all the disadvantages

of trying to use a cell phone for Web access. One option is buying a connector

kit that allows you to use a GPRS or 1XRTT cell phone for wireless data

access.

If your business is planning on investing in converged devices, be sure to ask your carrier what your options are for upgrading the data access feature as the network changes.

For immediate access to GPRS networks, consider either the Handspring Trēo or a PocketPC PDA and modem combination.

Because of their

usability problems, avoid converged devices based on the cell phone form

factor. Such devices are also more likely to become obsolete before the end of

their useful lives.

Taking

Advantage of the Opportunity

With all the hype, it�s hard to determine exactly where and when the business opportunities represented by wireless devices will materialize. Equally hard is figuring out how these changes in commerce and information access will affect businesses� processes and prospects. If your organization wants to take the wireless plunge and develop your own wireless applications, first you need to identify the business problem to solve. Next match the wireless application to the problem. Finally, determine the kinds of wireless devices you want to support and the functions you want to deliver.

Potential Wireless Applications

In the future,

the scope of wireless applications is likely to include pretty much any kind

of computing. Today, however, applications are limited by the restrictions

imposed by the devices and networks currently available.

Today�s

phones present a challenging applications development environment. Developers

of applications for phones must work within the following limitations:

-

Less powerful CPUs � you can�t count on lots of speed and graphics-processing capabilities

-

Limited memory (RAM and ROM) � typically a few megabytes or less Restricted power consumption � any computation-intensive applications can quickly draw down the battery

-

Small displays � most phones display less than a dozen lines of 20 to 30 characters; PDAs and converged devices may offer screens up to 640x480 pixels

-

Difficult input devices � it�s difficult to type using only 12 keys, and thumb keyboards have given rise to new repetitive stress maladies

-

Limited bandwidth � speeds are typically 9600bps to 19.2Kbps and it will be awhile before they match even wired modem speeds

-

Latency � often gateways and other translators stand between the Internet and the phone

-

Security � most devices have no physical security and transmit text in the clear; additionally, the servers receiving information may be vulnerable

Despite these limitations, there are many fertile areas for development. Below

is a list of some potential application areas you can start exploiting today.

-

Sales Force Automation � Sales people spend between 20 percent and 80 percent of their day away from a PC terminal or wired computing device. The wireless phone can provide instant, direct access to the latest pricing and competitive information, sales lead and contact information, the latest news from the office, and data-sheets or brochures.

-

Dispatch � Delivery and service personnel can keep abreast of schedule changes, update order records, and order replacement parts

-

Real-time Delivery of Content � Get current information about weather, traffic alerts, news and stocks

-

Banking � With wireless banking already popular in Europe, US banks will bring ATM features such as balance and funds transfer as well as bill payment to the display of a wireless handset

-

Electronic Commerce � M-commerce, electronic commerce over wireless may turn into one of the most lucrative uses of the new technology. Financial companies like Citigroup, Credit Suisse, Deutsche Bank AG, MasterCard and Visa are betting that it will be.

-

Email � Email was the original killer app that drove connectivity on the early Internet. It remains the most ubiquitous application on wireless networks.

-

Organizer � The Holy Grail of mobile computing is the convergence of telephone, browser, and organizer. Remote synchronization of phone lists, calendar, to do lists, and appointments while away from the office will become a popular application.

-

Instant Messaging � IM is one of the killer apps of the Internet, at least for teenagers around the world. The hassle of pecking out messages using the telephone keypad would seem to severely hamper the adoption of this technology, however. Predictive text services like those available on some Nokia phones[12] help make message composition less of a chore. VoiceStream now offers phones with AOL�s Instant Messenger built in and Openwave recently announced new software that will allow cell phone users to send IMs to MSN Instant Messenger subscribers.

-

Auctions � Another natural application for untethered devices is real-time auction notifications. Being informed when overbid or when a desired item comes up for auction is a real value-added application that benefits from being set free of the PC. Equally valuable is the ability to interact with the auction and increase your bid.

-

Games � Where computers have gone, games have quickly followed. It will be the same for wireless devices, many of which already feature built-in games. Networked wireless games will be limited for a time by the low bandwidth available, but by the end of the decade, expect to be able to play networked Quake on your phone.

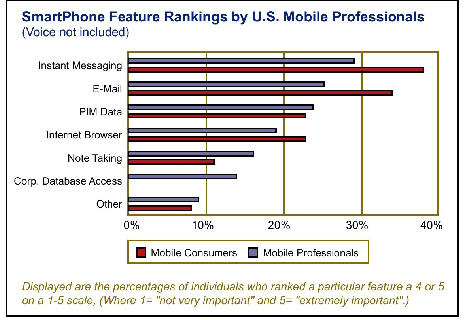

Which of these

applications are your employees likely to want first? ResearchPortal did a

survey of people who were planning on buying a cell phone. They asked what

features these prospective customers considered to be most valuable.

The sample included both consumers and mobile professionals and the

answers are revealing.

Surprisingly,

instant messaging (which we imagine includes paging functions) was the most

desired feature by mobile professionals.

Equally surprising was the fact that consumers rated both messaging and

email more highly than did the professionals.

Understandably, professionals ranked the ability to manage Personal

Information Manager (PIM) data higher than did consumers.

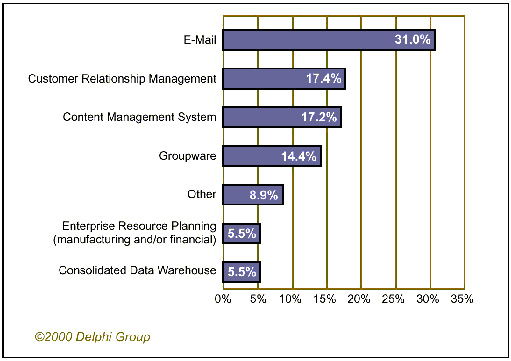

A Delphi Group study found that wireless email was likely the first application to be employed in business. Interestingly, the next in line were Customer Relationship Management (CRM), which we assume includes PIM data access, and content management, and that implies the ability to edit documents on wireless devices.

Match the Features to the Device

Currently, there

are a variety of access protocols and methodologies in use in wireless

devices.

Selecting the devices you want to

support necessarily affects the standard you will end up dealing with. Also, the functions you want to deliver can determine which

devices you support.

As you embark on

developing your first wireless application, the myriad of options for

functionality and devices makes it very important to choose a manageable

feature set and a manageable device set.

The table that follows lists wireless functions and which devices are

most suitable for their delivery.

|

Wireless

Function |

Target

Device |

|

Email Access |

|

|

|

BlackBerry, PalmOS PDAs with OmniSky, Novatel, Palm VII with third party software, Palm i705 |

|

Proprietary |

Palm VII, most mobile phones |

|

|

Mobile phones (particularly GSM-based), BlackBerry, Palm i705, PocketPC-based PDAs (PDAs don�t typically have �always on� wireless access, but that�s changing) |

|

Synch PIM data |

BlackBerry, some phones (PDAs typically require wired synching via cradles) |

|

Web Access |

|

|

|

PalmOS PDAs with OmniSky, Novatel, Palm VII with third party software, Palm i705, PocketPC PDAs |

|

Proprietary Access |

Palm VII (web clipping), mobile phones |

|

|

Software like Netbility�s WLServer, Information Builders� WebFocus and others, custom portal development |

|

|

PalmOS and PocketPC PDAs with third party software, some mobile phones, custom portal development |

A key point to

remember when selecting the devices to support revolves around the immediacy

of access. In the past, PDA-based

access was not instant because the devices are not �always on.� This means

the user must take steps to access wireless information. In the case of the

Palm VII, the user must raise the antenna and take one or more steps to select

and activate an application to receive the information. The new generation of

devices like the BlackBerry (and similar pagers), the new Palm i705, and

mobile phones, by contrast, can receive messages with little or no delay.

Another point to keep in mind is that with custom development, virtually any kind of informational or interactive application can be ported to almost any wireless device. The real key here is support. The number of different devices you need to support could determine how difficult your support efforts become. This becomes especially apparent if you need to make copies of or modification to your existing Web content to support a device.

The key to

staying on top of wireless developments will, unfortunately, be flexibility.

New services and standards are evolving almost daily, and the state of the art

moves very rapidly. That�s why subscribing to an information service such as

CTOMentor is a must to avoid being overtaken by events.

One thing is for certain: Devices will be a significant part of the future of computing. It is very likely that by the end of this decade, you will not longer sit down at a personal computer to do computing. Computing will have disappeared into the environment and you�ll have access anywhere.

Conclusion

Many pundits

predict a gold rush mentality in the wireless marketplace over the next

several years. If this is so, it is best to remember who really made money in

the original gold rush: the merchants who sold picks and shovels to the

miners. It could be that the real wireless winners will be tool and

infrastructure vendors.

The key traits of the wireless winners will be speed to market, flexibility and innovation. So it�s never too early to dive into the wireless market and see how it can transform your business.

Visit the Authors Web Site

![]() Click Here

for The Business Forum Library of

White Papers

Click Here

for The Business Forum Library of

White Papers

![]()

Search Our Site

Search Our Site

Search the ENTIRE Business

Forum site. Search includes the Business

Forum Library, The Business Forum Journal and the Calendar Pages.

Disclaimer

The Business Forum it's Officers, partners, and all other

parties with which it deals, or is associated with, accept

absolutely no responsibility whatsoever, nor any liability,

for what is published on this web site. Please refer to:

Home

Calendar

The Business Forum Journal

Features

Concept

History

Library

Formats

Guest Testimonials

Client Testimonials

Experts

Search

News Wire Join

Why Sponsor

Tell-A-Friend

Contact The Business Forum

The Business Forum

Beverly Hills, California United States of America

Email: [email protected]

Graphics by DawsonDesign

Webmaster:

bruceclay.com

� Copyright The Business Forum Institute 1982 - 2012 All rights reserved.

![]()

�

�

�